Side Hustle FIRE Calculator

Side Hustle FIRE Calculator

Calculate how side income can accelerate your path to financial independence

Enter your income sources and savings rates.

Add your investment accounts and expected returns.

Set your financial independence targets and timeline

How to use this calculator

This Side Hustle FIRE calculator helps you understand how supplemental income can accelerate your path to financial independence. The calculator uses realistic default values to provide a starting point for calculations.

Start by entering your income information:

- Annual side hustle income (default: $24,000) This is your pretax number.

- Side hustle savings rate (default: 50%) Make sure to consider business expenses and taxes.

- Annual main job income (default: $80,000)

- Main job savings rate (default: 10%)

Investment Details

Configure your investment settings with these options:

- Annual Return Rate (adjustable from 0-20%, default: 7%). According to NerdWallet, the average annual return of the S&P500 is 10% over the past century. I chose to be more conversative in my default settings to account for down years.

- Multiple Asset Types (add up to 6 different investment categories)

- Custom Asset Names (specify investment types like stocks, bonds, etc.)

- Individual Return Rates (set specific returns for each asset class)

Spending & Goals

Set your financial targets and assumptions:

- Current annual spending (default: $40,000)

- Retirement annual spending (default: $40,000)

- Current age (default: 30)

- FIRE goal retirement age (default: 65)

- End age for calculations is 90 years of age.

- Inflation rate (adjustable from 0-12%, default: 3%) The Federal Reserves aims for a 2% average annual rate of inflation.

Understanding the calculations

Investment Growth Calculations:

Future Value = Present Value × (1 + return_rate)^years

Inflation Adjusted Value = Future Value ÷ (1 + inflation_rate)^years

Annual Savings Calculations:

Main Job Savings = Annual Main Job Income × Main Job Savings Rate

Side Hustle Savings = Annual Side Hustle Income × Side Hustle Savings Rate

Total Annual Savings = Main Job Savings + Side Hustle Savings

Investment Return Calculations:

Annual Return = Total Invested Assets × Annual Return Rate

Total Assets = Previous Year Assets + Annual Savings + Annual Return - Annual Retirement Spend

How the calculator handles multiple investment types and returns

Let me explain how the calculator handles multiple investments with different return rates using an example:

Let's say you enter:

- Investment 1: $75,000 in Stocks with 8% return

- Investment 2: $25,000 in Bonds with 4% return

Here's how the calculation works:

First, it calculates the weighted return:

// Total assets = $75,000 + $25,000 = $100,000

// Stock weight = $75,000 / $100,000 = 0.75 (75%)

// Bond weight = $25,000 / $100,000 = 0.25 (25%)

// Weighted return = (0.75 × 8%) + (0.25 × 4%)

// = 6% + 1%

// = 7% weighted average return

Then for each year:

// Year 1 example with $20,000 annual savings:

const annualReturn = $100,000 × 0.07 = $7,000

totalAssets += $7,000 + $20,000 = $127,000

Important notes:

- The tool assumes the weighted return remains constant. This tool also assumes you reinvest your saved side-hustle and job income at the first of the year.

- New investment totals added each year will yield the overall weighted return of your investments.

- In reality, you'd want to periodically rebalance the portfolio as you age.

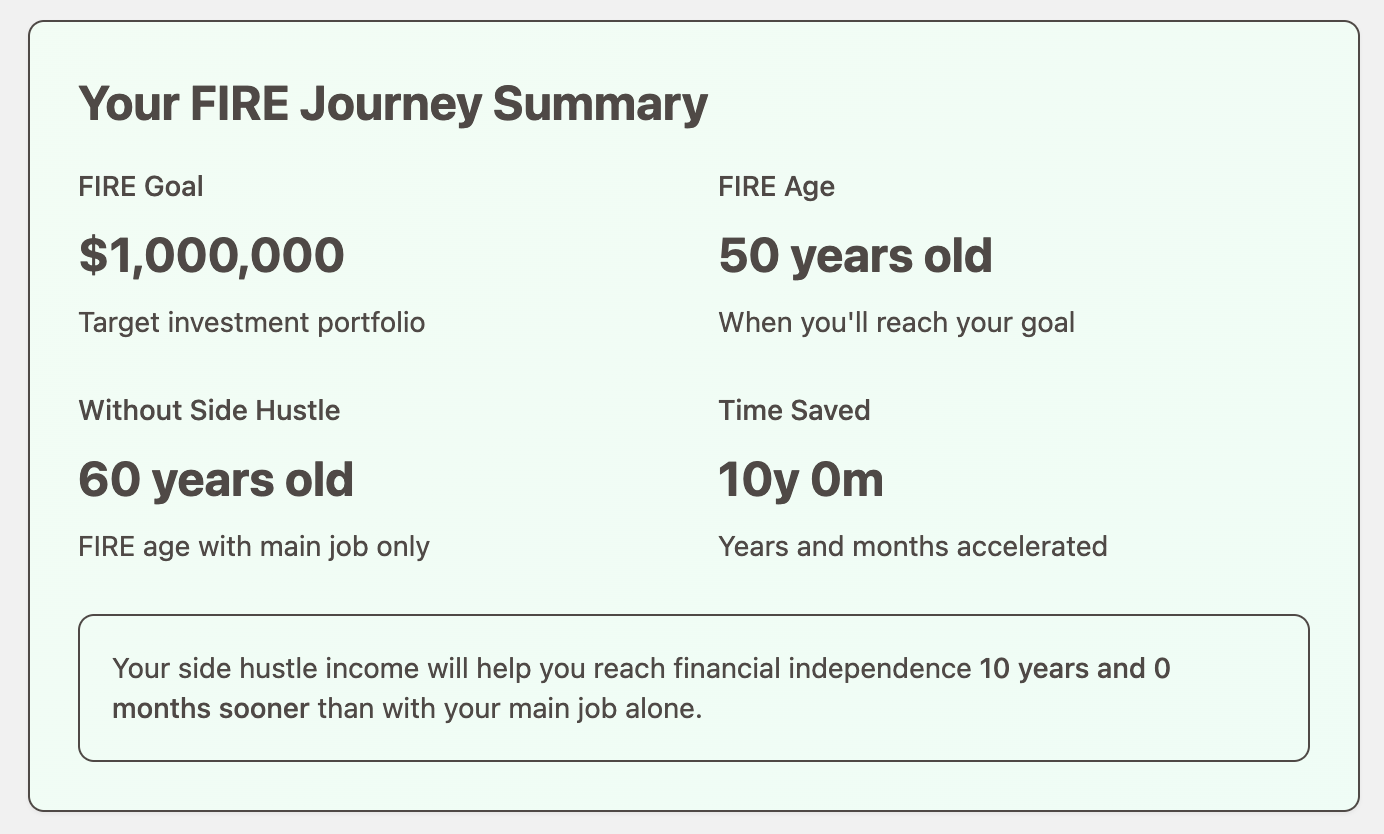

Analyzing Your Results

The calculator provides comprehensive insights through various outputs:

- FIRE achievement timeline with and without side hustle

- Visual chart showing investment growth versus FIRE goal

- Detailed yearly financial breakdown

- Time saved through side hustle contributions

- Inflation-adjusted projections

Remember that while this calculator provides valuable projections, market returns will vary significantly over time. Consider running multiple scenarios with different return rates and savings assumptions to better understand potential outcomes.

Use the CSV export feature to save your calculations and track how changes in your income, savings rate, or investment returns might affect your FIRE timeline.

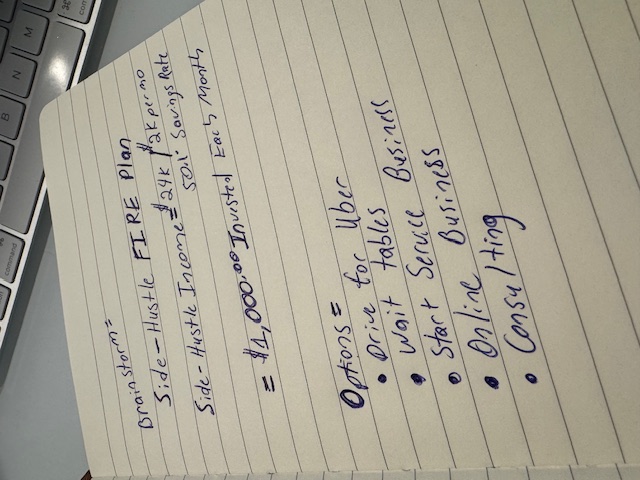

How to Think About a Side Hustle

I'm a big believer in using a side-hustle to improve your finances and it's been the primary wealth creator in my own life. I view a side-hustle as a nearly risk free venture. You get to keep your current job, learn some new skills, and get a shot at major financial upside depending on the business you want to start.

By default in this calculator, you are essentially netting $1,000 per month with your side hustle. If you hit it hard, you might be able to accomplish this through driving for Uber on weekends, waiting tables on the side, or starting a service business.

If you follow this process for a few years, you start to see how a side-hustle can shave years off your financial goals in the chart.