Opportunity Cost Calculator for Investing Decisions

Compare investment returns, debt savings, and inflation impact in just a few clicks. This tool even runs “what-if” scenarios against the historical performance of stocks, real estate, or bonds to compare common investment choices side by side.

Investment Details

How to Use the Calculator

Basic Inputs

- Initial Investment: Enter the amount you plan to invest or use to pay down debt.

- Annual Return: Input the expected annual return rate of the investment you're evaluating.

- Time Horizon: Specify the investment period in years and months that you would like money to be invested. A long term investment is considered more than 10 years and short-term is less than 3 years.

- Tax Rate: Enter your tax rate (for qualified dividends, tax rates are typically 0%, 15%, or 20% depending on your income).

- Inflation Rate: The calculator defaults to 4.1% based on 2023 data. Keep in mind the rate of inflation changes every year so this number will never be exactly the same on a year over year basis.

- Goal Amount: Set a target amount you'd like to reach if you have a specific goal like paying for college or saving a down-payment on a home.

Advanced Features

Debt Comparison

Toggle this option to compare investing versus paying down debt. The calculator uses current credit card interest rates that are close to 20% as a default.

In my opinion, if you're paying high-interest consumer debt at this rate, it almost always makes more sense to pay off the credit cards instead of investing. It will be extremely tough to beat a 20% rate of return on your money and get a better return than simply paying off debt. It's boring, but that's how the numbers work out.

Interpreting the Results

Future Value Section

- Shows your total projected investment value based on your inputs.

- Displays returns after accounting for taxes.

- Provides the real value adjusted for inflation while you had the cash invested.

Goal Progress

The calculator compares your results to your goal amount, helping you determine if your investment strategy aligns with your objectives.

What If Scenarios

The calculator compares your strategy with historical returns from different investment types, based on 10-year performance data from BankRate:

- Stocks (12.8% annual return)

- Real Estate (4.2% annual return)

- Bonds (1.5% annual return)

Important Note: While historical returns are helpful for perspective, past performance does not guarantee future results. Use this as a guide, but remember that investment outcomes can and will vary.

Understanding the Calculations

Future Value Calculation:

The calculator uses the following compound interest formula:

Future Value = Initial Investment × (1 + Monthly Rate)^(Number of Months)

Real Value Adjustment:

This is to account for inflation and the reduced purchasing power of dollars over time.

Real Value = Post-Tax Value ÷ (1 + Monthly Inflation)^(Number of Months)

Investment Return:

Investment Return = Future Value - Initial Investment

Tax Amount = Investment Return × (Tax Rate ÷ 100)

Post-Tax Value = Future Value - Tax Amount

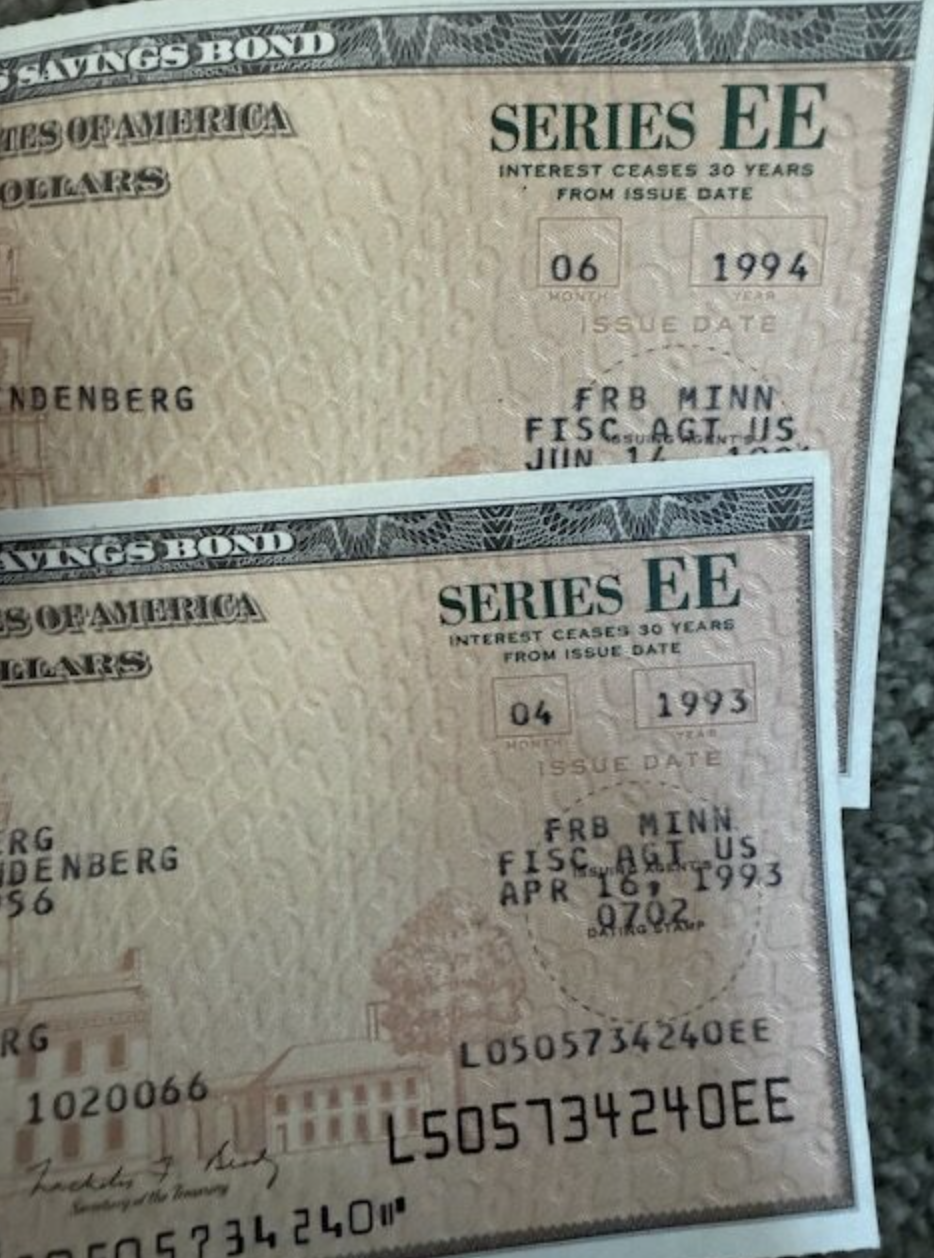

Should You Pay off High-Interest Debt or Invest?

If you have high-interest credit card debt, it acts as a heavy financial anchor, draining your money faster than most investments can grow. Paying it down first is like earning a guaranteed 20% return at the current credit card interest rates. This something even the best investments can rarely match.

According to CBS, the average credit card interest rate in October, 2024 was a staggering 23.37%. If this is your situation, it makes even more financial sense to pay off debt instead of investing.

Using the opportunity cost calculator, you can easily see the difference:

- Debt Service Savings: Enter $20,000 at 20% interest, and the calculator will show you the $8,000 saved in avoided interest.

- Savings Option: Enter the same amount in a savings account with 4% interest, and you'll see a projected return of just $1,632.

This stark difference demonstrates why paying off high-interest debt is the best financial move in most cases.