Annual Income Calculator: Calculate Yearly Salary & Take-Home Pay

Annual Income Calculator

Choose Conversion Type

Income Details

Hourly Rate

Work Schedule

Tax Calculation

Annual Income Calculation Results

Sample results - click Calculate Pay to see your data

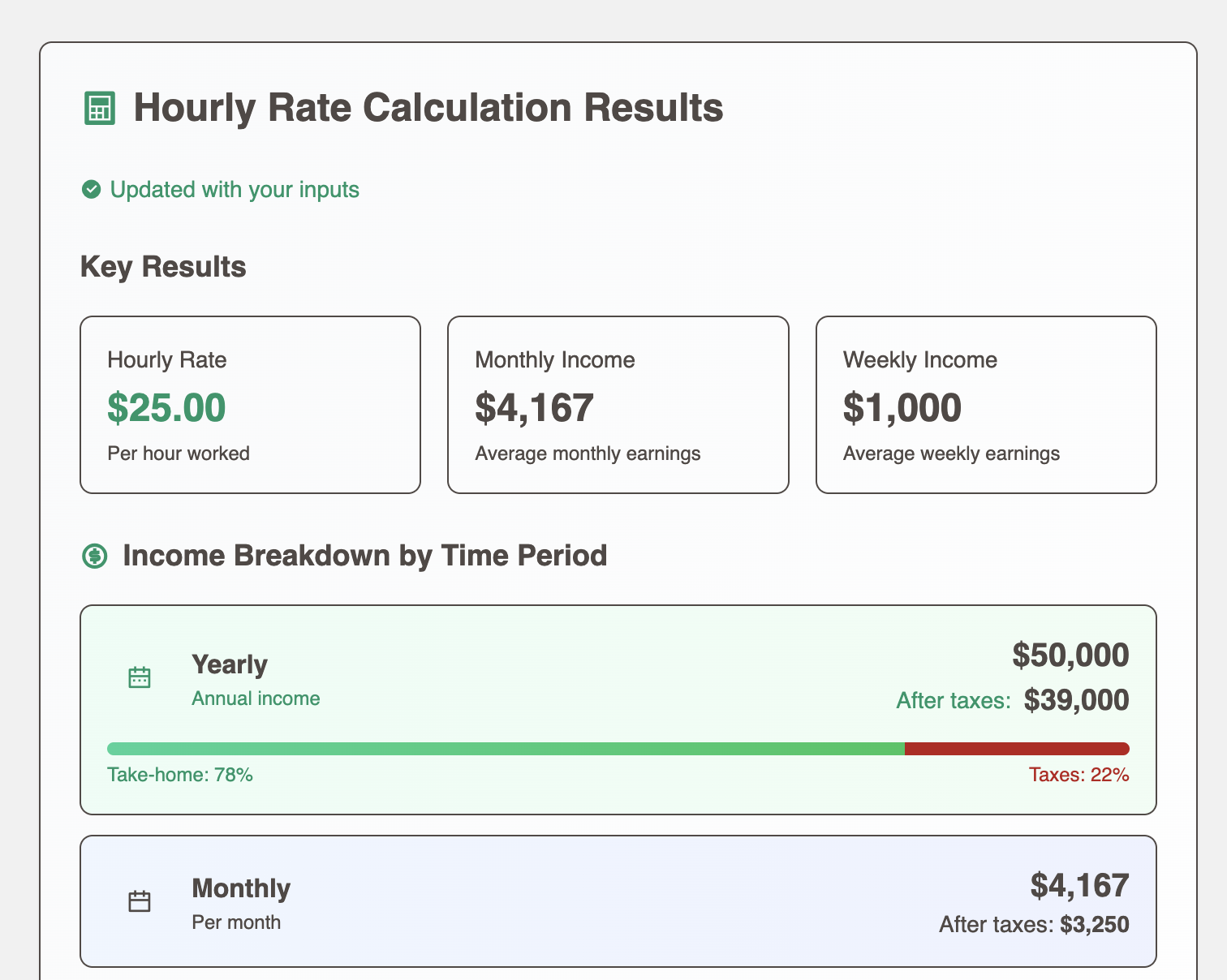

Key Results

Annual Income

Gross yearly earnings

Monthly Income

Average monthly earnings

Weekly Income

Average weekly earnings

Income Breakdown by Time Period

Yearly

Annual income

Monthly

Per month

Weekly

Per week

Hourly

Per hour

Work Schedule Breakdown

Weekly Hours

Hours per week

Annual Weeks

Working weeks

Total Hours

Hours per year

Tax Information

Tax Rate Used

22%

Annual Taxes

$11,000

Note: Tax calculations are estimates. Actual taxes depend on filing status, deductions, and location.

How to Use This Annual Income Calculator

If you're trying to determine your yearly salary from an hourly wage or wondering what your true hourly rate is, this annual income calculator is the tool you need. Whether you're comparing job offers, planning a budget, or simply curious about your earning potential, understanding the relationship between hourly and annual income is crucial.

I built this calculator based on my experience helping friends and colleagues navigate salary negotiations. Too often, people focus solely on the headline number without considering taxes, actual working hours, or how their income breaks down into manageable periods. This tool addresses those gaps.

Step 1: Choose Your Conversion Direction

Start by selecting whether you want to convert from hourly to annual income or from annual salary to hourly rate. This flexibility makes the calculator useful whether you're:

- An hourly worker calculating potential yearly earnings

- A salaried employee understanding your hourly value

- Comparing job offers with different compensation structures

- Planning freelance or contract rates

Step 2: Enter Your Income Information

Input either your hourly rate or annual salary. The calculator uses sensible defaults—$25/hour or $50,000/year—based on current market averages. According to the Bureau of Labor Statistics, the average hourly wage for all employees is approximately $33, but this varies significantly by industry and location.

Consider Hidden Time Costs

Financial educator Bob Lotich reminds us to consider unpaid time that affects your true hourly wage: "Each day I had a lunch break where I wasn't paid but I really couldn't go anywhere so it's kind of like trapped." Don't forget to factor in commute time and unpaid breaks when calculating your real compensation.

Step 3: Customize Your Work Schedule

Not everyone works the standard 40 hours per week, 52 weeks per year. This calculator lets you adjust:

- Hours per Week: Set anywhere from part-time (20-30 hours) to overtime schedules

- Weeks per Year: Account for unpaid time off, seasonal work, or contract periods

Quick Tip

If you receive 2 weeks of paid vacation, you still work 52 weeks worth of pay. Only reduce weeks if you take unpaid time off.

Step 4: Include Tax Calculations

One of the most valuable features is the tax calculation option. By entering your estimated tax rate (combining federal, state, and local taxes), you can see your actual take-home pay. This gives you a realistic picture of what you'll have available for budgeting.

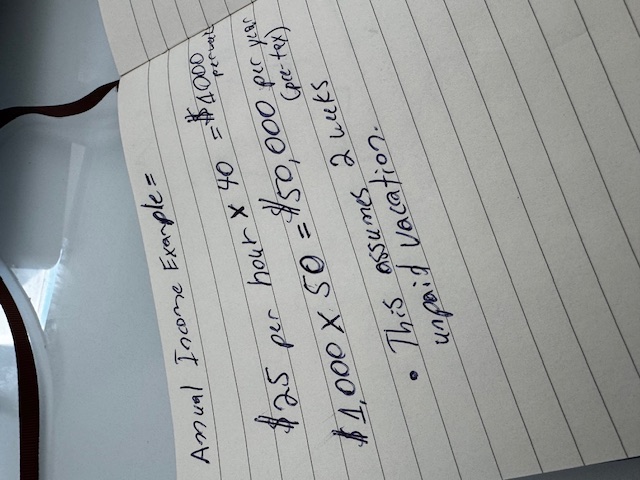

Back-of-Napkin Annual Income Calculation

Here's a simple way to estimate your annual income yourself without the calculator. As recruiting expert Ricky Paloy explains, you can take your hourly rate and multiply it by 2,080 hours. This is the standard number of hours many people work per year in the United States based on 40-hour work weeks.

Simple Formula

Hourly Rate × 2,080 hours = Annual Salary

Example: $25/hour × 2,080 = $52,000/year

Ricky Paloy, CEO of Riam Recruiting: "Whatever your hourly earnings are you're going to put it into a calculator and multiply it by 2080 and that will be your annualized salary based off of 40 hours a week."

Understanding Your Results

The calculator provides a comprehensive breakdown of your income across different time periods:

Example: $25/hour at 40 hours/week

| Annual (gross) | $52,000 |

| Monthly (gross) | $4,333 |

| Weekly (gross) | $1,000 |

| After Tax (22%) | $40,560/year ($19.50/hour) |

Calculator Formulas Explained

I believe in transparency, so here are the exact formulas I use in this calculator. Understanding the math behind the results helps you verify the accuracy and apply these calculations in your own financial planning.

Core Calculations

Annual Income from Hourly Rate:

Annual Income = Hourly Rate × Hours per Week × Weeks per Year

Hourly Rate from Annual Salary:

Hourly Rate = Annual Salary ÷ (Hours per Week × Weeks per Year)

Monthly Income:

Monthly Income = Annual Income ÷ 12

Weekly Income:

Weekly Income = Annual Income ÷ Weeks per Year

After-Tax Calculations:

Net Income = Gross Income × (1 - Tax Rate ÷ 100)

Applied to all time periods (annual, monthly, weekly, hourly)

Bob Lotich, Financial Educator: "I had to leave a half an hour or more before... to drive all the way downtown and then I had to drive usually... half an hour back." Consider these hidden time costs when evaluating your true compensation.

Why Gross vs Net Income Matters

Understanding the difference between gross (before tax) and net (after tax) income is crucial for financial planning. Your gross income is what's advertised in job postings and salary negotiations, but your net income is what actually hits your bank account.

A common mistake I see is people budgeting based on their gross income. For example, if you earn $50,000 annually, you might think you have $4,167 per month to spend. But after taxes (assuming a 22% rate), you actually have about $3,250. That's a $917 difference that can make or break a budget.

Using This Calculator for Career Decisions

Comparing Job Offers

When evaluating job offers, use this calculator to put everything on equal footing. For instance:

- Job A: $60,000 salary with standard hours = $28.85/hour

- Job B: $27/hour with consistent 45 hours/week (5 hours overtime) = $63,180/year

Job B actually pays more annually due to overtime, even though the base hourly rate is lower than Job A's equivalent.

Setting Freelance Rates

If you're transitioning from employment to freelancing, remember that your hourly rate needs to cover more than just your previous salary. As a freelancer, you'll need to account for:

- Self-employment taxes (additional 7.65%)

- No paid time off

- Health insurance and benefits

- Business expenses

A rule of thumb: your freelance rate should be at least 25-50% higher than your employed hourly rate to maintain the same standard of living.

Related Calculators

Understanding your annual income is just the first step in financial planning. Check out the Salary to Hourly Calculator for more detailed analysis including overtime calculations and benefits comparison. For budgeting purposes, you might also find our monthly expense calculators helpful in planning how to allocate your income effectively.

Note on Tax Calculations

This calculator provides tax estimates only. Actual taxes depend on many factors including filing status, deductions, credits, and state of residence. Consult a tax professional for accurate tax planning.